World’s two largest asset managers have invested $170bn in coal

The worldãs two largest money managers have built a combined $170 billion investment portfolio in coal using money from peopleãs private savings and pension contributions, despite a global push for carbon neutrality, a new report shows.

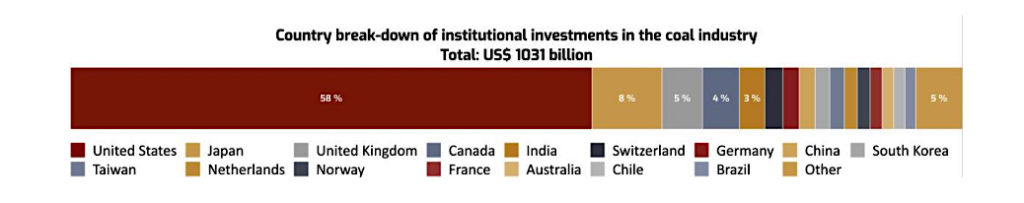

The eye-popping figure pales in comparison to the astronomical $1 trillion in coal investments held by 4,488 institutional investors as of January this year, a , reveals.

US asset managers BlackRock and Vanguard, the worldãs No.1 and No. 2 investment firms respectively, hold $86 billion and $84 billion worth of coal assets each.

US investors account for nearly 60% of all institutional investments in the global coal industry

ãWhile many large EU investors have begun screening coal companies out of their portfolios, the vast majority of US investors have refused to adopt coal exit policies,ã Katrin Ganswindt, head of financial research at Urgewald, .

BlackRock has divested from fossil fuel companies that generate more than a quarter of their revenues from thermal coal in its discretionary active investment portfolios. About $5.7 trillion of its assets, however, are held in tracker funds, which means it must rely on voting powers to sway companies to commit to zero emissions by 2050.

Pennsylvania-based Vanguard has pledged to support the global move towards cutting emissions, but it has not joined Climate Action 100+, a coalition of 545 institutional investors that supports cuts in carbon emissions and improvements in climate disclosures.

US at the top

American investors account for nearly 60% of all institutional investments in the global coal industry, and a vast majority of them refuse to adopt coal exit policies, the report claims.

The research, published on Thursday, attempts to analyze commercial banksã and institutional investorsã exposure to the entire coal industry.

ãIt represents the first effort to do so,ã Ganswindt said. ãIn past years, the scope of our financial research was limited to around 200 coal plant developers. Our new research, however, analyzes financial flows to all 934 companies on .ã&ýåýºý¾ÝÒ;

Asset managers and pension funds have vowed to help countries reach targets agreed on at the 2015 Paris conference to stop global warming, which will require significant reductions in fossil fuel consumption.

Green groups argue that the finance industry seems more interested in ãgreenwashingã than addressing the task of reducing carbon emissions.

Paddy McCully, climate and energy program director at Rainforest Action Network, said the new US administration must address the role of Wall Street as a driver of climate pollution.

ãWall Streetãs massive investments in the coal industry are driving us ever deeper into a climate crisis,ã he said.

Japanese lead commercial banks

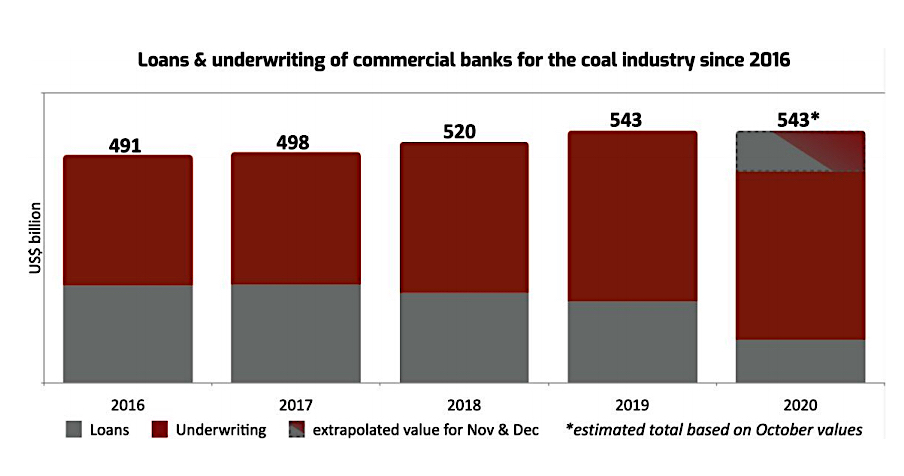

The study identified 381 commercial banks providing $315 billion in loans to the coal industry over the past two years. The top three lenders from the group were Japanãs Mizuho ($22bn), Sumitomo Mitsui Banking Corporation ($21bn) and Mitsubishi UFJ Financial Group ($18bn). The fourth and fifth major coal lenders were US-based Citigroup (US$ 13.5bn) and Englandãs Barclays ($13.4bn).

The report also found that, over the last two years, 427 commercial banks channeled over $808bn to companies on the GCL through underwriting.

The worldãs top five underwriters were all Chinese financial institutions, including the Industrial and Commercial Bank of China ($37bn), the China International Trust and Investment Corporation (US$ 32bn), the Shanghai Pudong Development Bank ($28bn), the Bank of China ($24bn) and the China Everbright Group ($23.7bn).

In a rather unexpected finding, the research concluded that commercial banks have been channelling more money to the coal industry than in 2016, the year after the Paris agreement was signed. Banks provided then $491bn through lending and underwriting to companies listed on the GCEL. By 2019, this amount had jumped to $543bn ã an almost 11% increase.

ãThese numbers provide a sobering reality check on bankãs climate commitments,ã Yann Louvel, policy analyst for the NGO Reclaim Finance .

ã[It confirms that] the vast majority of banksã coal policies have so many loopholes that their impact is almost meaningless.ã

More News

{{ commodity.name }}

{{ post.title }}

{{ post.date }}

Comments

And they did right. Because even to do pv in chain-A you need coal. I am chafed of this ridiculous narrative. and the Germans opened a coal power station in the may of 2020… inveiglers, this planet is flooded by inveiglers.